Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

The Elements of a “Theory Y” Budget

By Scott Lazenby

In previous columns, I have argued that to be aligned with what we know about good management practices, budget decision making should be decentralized as much as possible. The governing board should set overall priorities, which affect the allocation of general tax resources to each general fund program. Operating managers should be accountable for outcomes and manage to the bottom line, with full flexibility to transfer budget amounts across line items and offset expenses through carryover savings and departmental revenues.

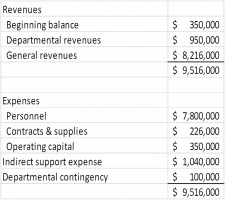

In practice, what does this kind of budget look like? Here’s an example for a hypothetical program or department within a government’s general fund:

The first thing to note is this looks like a budget for an enterprise fund or special revenue fund, where expenditures are fully balanced by revenues. As the fiscal year unfolds, actual revenues and expenses will differ from the budgeted amounts since the budget is only a plan. The manager responsible for the budget will simply be required to ensure that actual expenses are within actual revenues. The government may still need to set appropriations (on the expense side only) to satisfy arcane legal requirements, but that appropriation serves no other useful purpose.

Some other notes:

- The departmental beginning balance is the net savings (or loss) from the prior fiscal year. It is budgeted expenses less actual expenses plus actual revenues less estimated revenues for the prior fiscal year.

- Departmental revenues are those within the control of the department such as fees for service.

- General revenues reflect the allocation of general taxes to this department, set by the CEO (with policy direction from the governing body) at the beginning of the budget process.

- The “indirect support expense” line item assumes that all support services (HR, Finance, IT, etc.) are directly expensed to the “customer” departments, even within the general fund.

- The departmental contingency is just that. In traditional budgets, operating managers create their contingency accounts by padding certain line items. Having an explicit contingency line item acknowledges that the budget is just a crap shoot and allows operating managers to build more realistic estimates of line item expenses without the need for padding.

This example reflects the end result of a “Theory Y” budgeting process. How it’s arrived at is just as important as how it looks. In the next column we’ll look at an alternative to the traditional budget games.

Scott Lazenby is the city manager for the City of Lake Oswego (OR) and is an adjunct associate professor at Portland State University. He can be reached at [email protected].

John S Weidl

November 12, 2013 at 4:02 pm

We are using Theory Y in our local government and we also use a biennial budget process. In the span on just a few short months, we have been able increase empowerment, build trust, and create a sustainable financial picture, all without the typical budget tricks associated with command and control systems.