Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

Economic Uncertainty and the State and Local Revenue Landscape

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Ben Tafoya

June 6, 2025

The health of the economy heavily depends on the expectations of consumers and firms. Consumers stimulate growth through their decisions about whether to allocate their marginal income to savings or consumption. Firms contribute through their decisions on hiring and investment. The government contributes through its decisions on spending and taxation, as well as by providing a solid foundation to facilitate the desired actions of consumers and firms. This is a time of deep uncertainty regarding the federal government’s policy direction, and there is cause for concern that the economy may exhibit weakness, which could play havoc with state and local budgets over the coming year or years.

There are numerous data points available to inform us about the direction of economic activity. The Bureau of Economic Analysis released the preliminary numbers for Q1 at the end of April, and they showed a slight decline in Gross Domestic Product (GDP) over the January through March period. The second estimate, released in late May, confirmed the decline that followed a solid increase in the last quarter of 2024. The Conference Board, a business group, measures “consumer confidence,” and the index released in late May showed a surprising rebound from the previous month. Overall, consumer confidence is below where it was at this date in 2024. Their parallel survey of small business optimism, conducted in April, dropped for the fourth consecutive month.

These readings, along with measures of unemployment and inflation, provide a picture of the economy’s current state and its potential direction. If consumers are cautious or despairing of economic conditions, then they may pull back on spending. Consumption of services and goods is the majority of expenditures that constitute US GDP. Consumption is a function of disposable income, which is income after taxes. The critical decision for consumers is how to allocate their income between spending and saving.

Firms make decisions about how much to invest (the Investment identity in GDP), how many workers to employ and at what wage. Firms will expand investment in plant and equipment if they see a profitable future for the extra capacity. If they become cautious, they will hold back that spending and potentially slow wage increases or reduce their headcount. Federal Reserve decisions about interest rates also play a significant role in the firm’s investment decisions, as the current high rates discourage some business investment at the margins.

In the current mode of operation, where the Administration makes announcements about economic policy, particularly trade and then pulls back the decisions soon thereafter, there is less certainty about the future. The courts have also begun to weigh in on the legality of the method chosen by the Trump Administration to impose tariffs. Not only the executive branch but also the judicial branch will cause some uncertainty, and Congress has not yet acted on proposals to restrict the executive’s ability to impose sanctions unilaterally.

Federal government spending is also injecting uncertainty into the economy. Public employees have been offered incentives to leave government service, terminated during probationary periods, had offers of employment rescinded and had been subject to reductions in force as agency work was effectively ended by order. While the courts have paused or reversed these actions, this may create cautious behavior among some in this sector. Moreover, the proposed budget for the next fiscal year may force cuts in Medicaid spending, which will have an impact on state spending. Serious questions exist as to the short-term commitment to spending on disasters, environmental protection and education. The ending of visas for international students has economic implications for the communities that host the students and their universities.

Consumption aids state and local budgets through sales tax collections on purchases subject to tax. Investment by firms can increase property valuations, leading to higher tax revenues. Hiring by firms can increase incomes and income taxes. A robust economy, accompanied by gains in the stock market, results in higher capital gains tax collections. Above all, the economy needs consistency and predictability of policy to perform at its best.

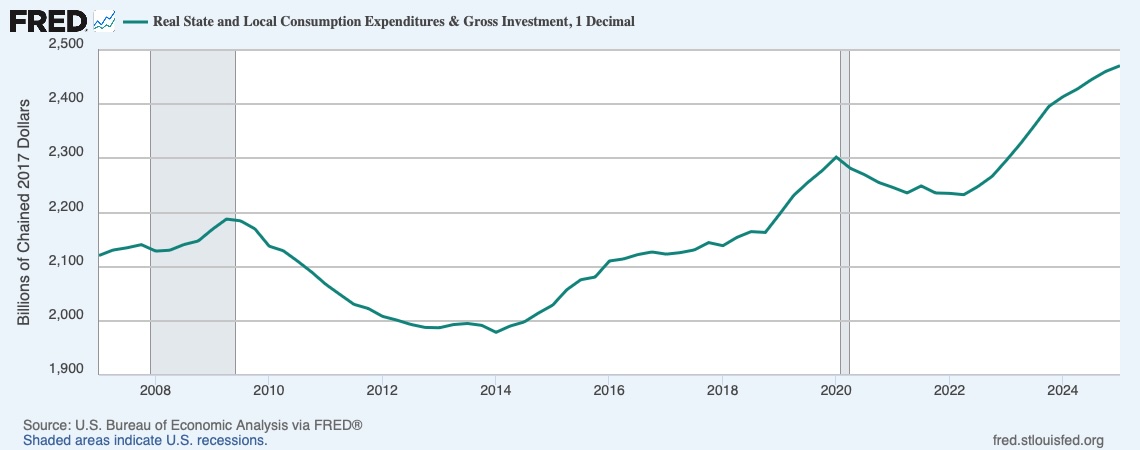

This uncertainty can dampen revenues for state and local governments. According to the National Conference of State Legislatures, while the picture today is unclear, there are signs of a pullback by state and local officials. There was already some pressure on budgets due to the conclusion of ARPA funding. More pressure was imposed by the withdrawal of monies from New York City’s accounts previously committed by the federal which is now the subject of a landmark court case.

Should economic conditions worsen with unemployment and inflation higher than optimal, the ability of policymakers to direct fiscal and monetary actions will be restricted. This will dampen state and local revenues, forcing tough choices on governors, mayors, county executives and their legislative bodies. Ultimately, whatever the decisions, the subsequent decline in public services will disproportionately affect the people who need them most.

Author: Dr. Ben Tafoya, a retired public administrator, is an adjunct faculty member teaching economics at Northeastern University in Boston. Ben is the author of a chapter on Social Equity and Public Administration in the volume from Birkdale, Public Affairs Practicum. He can be reached at [email protected] or on BlueSky @PolicyBen . All opinions and mistakes are his alone.

Follow Us!