Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

How Tariffs Are Fueling China’s Belt and Road—And What It Means for the U.S. Economy

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Derrick Phillips

May 5, 2025

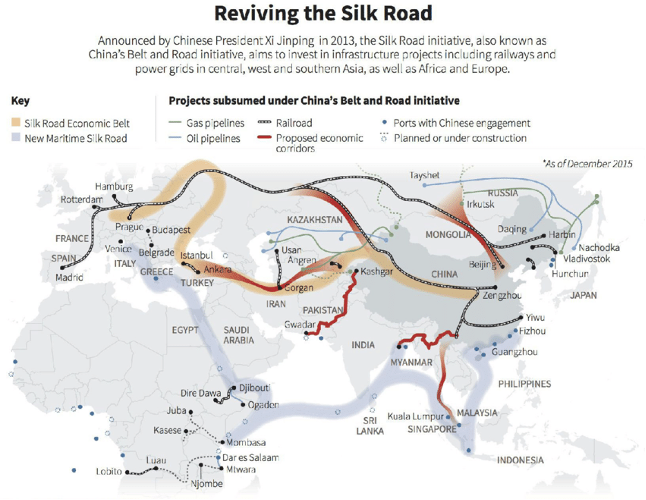

As the United States continues to wield tariffs as a tool of economic statecraft, particularly against China, an unintended side effect has emerged: the bolstering of China’s Belt and Road Initiative (BRI). What began as an ambitious infrastructure plan now serves as a counterweight to Western trade barriers, allowing China to offset the effects of tariffs by deepening its ties with developing economies across Asia, Africa and Latin America.

From an economic standpoint, this dynamic poses complex challenges to the United States. It reshapes trade flows, undercuts American industries and threatens long-term global competitiveness. While the national security implications are real, the economic consequences are more immediate and measurable, impacting American jobs, industries and trade influence.

TARIFFS REDIRECT TRADE AND STRENGTHEN CHINA’S ALTERNATIVES

U.S. tariffs on Chinese goods, especially those imposed during the 2018–2020 trade war, aimed to protect domestic industries and curb unfair trade practices. But instead of isolating China, these tariffs encouraged Beijing to diversify its trade relationships, primarily through BRI partnerships.

China responded by:

- Expanding trade with Southeast Asia, Africa and South America

- Accelerating infrastructure projects that reduce its reliance on Western-controlled trade routes

- Exporting surplus production to BRI nations through loans and construction deals

This strategic pivot has helped China absorb the economic shock of U.S. tariffs while simultaneously building long-term economic leverage through infrastructure control and trade connectivity.

ECONOMIC IMPACTS ON THE UNITED STATES

Trade Diversion and Market Leakage

As China reroutes its exports through BRI-partner nations, American imports increasingly arrive from third countries that act as intermediaries. For instance, goods flow through Vietnam, Malaysia or Bangladesh instead of direct shipments from China, often with minimal value-added transformation. This creates loopholes in the U.S. tariff policy, reducing its effectiveness. Moreover, American exporters face increased competition in emerging markets where China has entrenched itself through BRI-funded infrastructure and bilateral trade agreements.

Deindustrialization Through Price Suppression

China’s ability to offload surplus capacity, especially in steel, cement, solar panels and machinery, undermines U.S. efforts to revitalize domestic manufacturing. BRI projects serve as a dumping ground for Chinese goods, keeping global prices low and preventing American firms from scaling competitively.

This dynamic exacerbates:

- Layoffs in key industrial sectors

- Capital flight from U.S. manufacturing regions

- Weakening of strategic supply chains including steel, rare earths and clean tech

Loss of Infrastructure Influence and Standards

The BRI allows China to dictate the economic standards of new infrastructure worldwide, such as ports, railways, energy grids and digital systems. This shifts economic power and locks out American companies from engineering, construction and technology contracts. As BRI nations grow economically, their economic alliances lean toward China, reducing demand for U.S.-based services and goods. Over time, this erodes U.S. export potential in high-growth markets.

Undermining of Global Trade Norms

China uses the BRI to promote an alternative trade governance model that often sidesteps transparency, labor protections and environmental standards. This undercuts the rules-based trade order the U.S. helped establish post-WWII and weakens global institutions like the WTO. For American businesses operating under stricter compliance obligations, this creates a competitive disadvantage, especially in the infrastructure, energy and telecommunications sectors.

STRATEGIC ECONOMIC RECOMMENDATIONS

Modernize Trade Tools

Tariffs alone are insufficient. The U.S. should develop nuanced trade instruments that address value chain leakage, like rules of origin enforcement and enhanced trade intelligence platforms.

Expand Infrastructure Diplomacy

Invest in credible alternatives to BRI through the Partnership for Global Infrastructure and Investment (PGII), prioritizing transparency, sustainability and private sector engagement. U.S. firms should be empowered to compete globally, backed by coordinated diplomatic and financial support.

Reshore Critical Industries

Focus on domestic supply chain resilience in sectors like semiconductors, clean energy and pharmaceuticals. This includes tax incentives, regional innovation hubs and long-term investment in advanced manufacturing.

Support U.S. Exporters in Emerging Markets

Reinvigorate tools like the Export-Import Bank, Development Finance Corporation and USAID trade programs to help American companies compete in BRI-influenced markets. The focus should be on digital infrastructure, energy access and green technologies.

Conclusion: The Economic Front Is Strategic

Tariffs were intended as a punitive tool against Chinese economic behavior, but in practice, they’ve contributed to the expansion of China’s Belt and Road Initiative. This shift carries significant economic costs for the United States: weakened industrial capacity, reduced global trade influence and eroded leadership standards.

To protect its long-term economic interests, the U.S. must rethink its approach to global competition by imposing barriers and building systems, markets and alliances reinforcing American prosperity and resilience.

Author: Derrick Phillips is a 30-year St. Louis Fire Department veteran, serving as Operations Chief for the A-Shift, Executive Officer, and the Office of Homeland Security Commander. He holds a Master of Arts in Security Studies from the Center for Homeland Defense & Security at the Naval Postgraduate School and a Master of Public Administration from Arkansas State University. Chief Phillips also holds the Chief Fire Officer designation through the Center for Public Safety Excellence and is a graduate of the IAFC Fire Service Executive Development Institute.

Disclaimer

The opinions expressed in this article are my own and are not the official position of my agency.

Follow Us!