Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

Economic Redevelopment’s Hidden Gem: PACE Financing

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By James Cargas

March 27, 2023

The classic public-sponsored economic redevelopment program involves loans of public funds, tax breaks or grants. Not with Property Assessed Clean Energy (PACE) loans, which typically finance energy and water conservation improvements and on-site generation entirely from private capital providers at no cost to local governments.

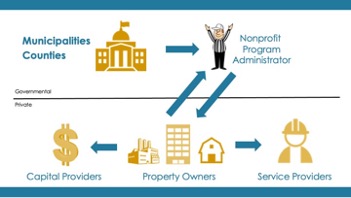

Yet PACE programs are run entirely by local governments—typically a county or city’s economic development or sustainability office. These public servants often contract program administration to a nonprofit third-party, like Texas PACE Authority, that have highly skilled staff and operational efficiencies. Currently, 38 states and the District of Columbia have commercial PACE programs.

Commercial, industrial, multifamily and nonprofit property owners often pay for an energy or water audit only to find out the recommended conservation measures cost more than they can afford and will take ten to twenty years to pay for themselves. A conventional bank loan will typically be an unsecured line of credit with a high-interest rate that pushes the breakeven point even further into the future.

PACE in Texas

In response, the Texas Legislature passed the PACE Act in 2013 and inserted it into Chapter 399 of the Texas Local Government Code. The PACE Act authorizes nonprofit, commercial, industrial and multifamily property owners to voluntarily place a priority lien on their land to secure a private, low-interest rate loan for improvements permanently affixed to the property. Because the local government files, holds and enforces the lien, it receives the same treatment as any property tax lien. If there is already a private mortgage on the land, the mortgage holder must consent to the PACE assessment.

In Texas, the property owner makes installment payments to the private capital provider. However, if the property owner defaults, the local government is responsible for enforcing the PACE assessment “in the same manner that a tax lien against real property may be enforced.” Both the tax code and the loan agreement permit the local government and capital providers to recoup their collection costs, including legal fees.

A PACE assessment is attached to the land and automatically transfers to the new property owner in the event of a voluntary or involuntary sale. This also means that the debt cannot be accelerated, and only past-due installments can be collected. Foreclosure does not extinguish the PACE lien.

PACE in other jurisdictions is also based on local assessment authority, but differs in details. For example, in Texas, an independent third-party reviewer (ITPR) must confirm the projected savings in the energy or water audit or on-site generation proposal, and later the ITPR must confirm the project is properly completed and is operating as intended. The ITPR requirement is absent or abbreviated in other states.

While most jurisdictions hire nonprofit program administrators to fulfill the governmental function of administering a PACE program, some have retained for-profit administrators or manage PACE programs themselves. In states where the same entity is both an administrator and a participant in the transaction (e.g., capital provider), conflicts of interest can arise quickly.

Some states, including California and Ohio, allow public bonds to be used to finance projects. Finally, a few states have residential PACE programs, but they will not be discussed here given their unique and narrow nature. Please consult an attorney about specific provisions in your state before establishing or administering a PACE program.

PACE Creates Positive Cash Flow

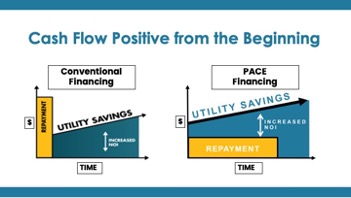

One of the most attractive aspects of PACE financing is that it can cover 100 percent of the cost of improvements, including the cost of audits, engineering and interest. This enables property owners to immediately start saving money from lower energy and water consumption without touching their savings.

By comparison, a conventional loan will typically be an unsecured equipment loan with a high interest rate, and never equal 100 percent of the costs incurred. Conventional loans often require between 15 percent to 25 percent of the property owner’s equity.

Additionally, conventional equipment loans rarely exceed five years, making for large monthly payments that impact a property owner’s cash flow. PACE loans have terms that approximate the useful life of the improvements, typically 15 to 25 years, but they can be as long as 30 years. By law, a PACE loan assessment, including its interest payments, cannot exceed the projected savings realized from the energy or water efficiency improvements.

Due to their priority status, and savings-to-investment ratio, PACE loans tend to have lower interest rates. When combined with conventional construction loan financing in the capital stack, PACE financing becomes even more attractive in today’s financial environment.

Policy Benefits of PACE

Local governments often view PACE financing as a key element of their climate action plans. In regions experiencing drought, PACE can offer relief to the local water utilities. PACE financing can be particularly useful to small, women-owned or minority-owned businesses and nonprofits because it reduces their energy burden. Larger businesses often use PACE financing to implement their environmental, social and governance (ESG) goals cost-effectively.

However, one of the greatest barriers to PACE implementation is education. The concept has been around for nearly two decades and has been adopted in 38 states plus the District of Columbia. Yet it remains a hidden gem for public administrators to discover.

Author: James Cargas has dedicated his professional career to implementing smart, sustainable, and renewable energy. Prior to founding Green Energy Law, LLC, James served at the Houston City Attorney’s Office, Department of Energy, Clinton-Gore White House, Federal Energy Regulatory Commission, and U.S. Congress. He is a graduate of University of Michigan and Washington College of Law. James is licensed in Texas, Washington DC, Michigan, and West Virginia.

Marc A. Wallace, Ph.D.

March 31, 2023 at 8:43 am

This is very insightful for state/local government and homeowners. I conducted a quick internet search for “PACE NJ” to search for a program. What timing! The New Jersey Economic Development Authority (NJEDA) will host a virtual public information session on the Garden State Commercial Property Assessed Clean Energy (C-PACE) Program on Friday, April 14 at 10:00 a.m. The session will provide an overview of the draft C-PACE program guidelines, which will be made available prior to the session. To be continued.