Financial Condition and Population Decline: The Challenge in Attracting Residents

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Daniel Hummel

August 24, 2019

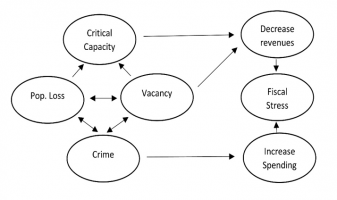

Tax base erosion has been described as one of the main reasons for local fiscal stress. This includes the out-migration of the middle and upper classes while the poorer classes remain behind. The city frequently spends more than it receives in tax revenues since the poor pay little or no taxes. A loss of population also signals increased housing vacancy. Vacant homes reduce the amount of property taxes paid while concordantly reducing the values of nearby homes and thereby their taxable value. Vacancy is also related to crime. An increase in crime can cause people to leave a city or part of a city while vacancy can also be a causal factor for crime. As crime increases the costs related to law enforcement increase as well, which further burdens the city government. Another impact from the loss of population is the critical capacity needed to maintain city services. This includes education, hospitals, public transportation and other areas. They need a critical mass to run efficiently. See figure 1 for how these factors interact to affect local financial condition.

Figure 1: Population-Induced Municipal Fiscal Stress Causal Diagram

These factors show how the loss of population can have detrimental effects on these cities’ budgets. Fiscal health is considered a core management goal. It is necessary to secure favorable terms to borrow for investments. In states like Michigan, local fiscal health is necessary to avoid state takeover, as states are directly impacted by local fiscal stress for their own credit ratings and responsibilities.

Fiscal health is usually measured as a comparison either to another unit or to itself over time. Several measures were developed in the 1970s and ‘80s as it became increasingly apparent that states and local governments were experiencing fiscal stress. The Federal government was cutting intergovernmental aid and several states experienced tax revolts starting with Proposition 13 in California.

One measure I like to use was developed by Wang, Dennis and Tu right before the Great Recession. This has become an increasingly popular measure. It measures the cash, budget, long-term and service solvency of the government. Cash solvency is focused on the cash standing of the government vis-à-vis current liabilities. Budget solvency is focused on revenues versus expenditures. This is the typical measure of fiscal health alone and has been adopted by organizations like the National League of Cities. Long-term solvency is focused on restricted and unrestricted assets vis-à-vis total assets, as well as long-term liabilities as compared to total assets. Service solvency is focused on taxes, revenues and expenditures on a per capita basis.

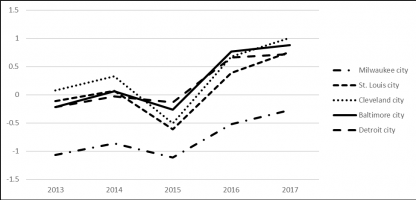

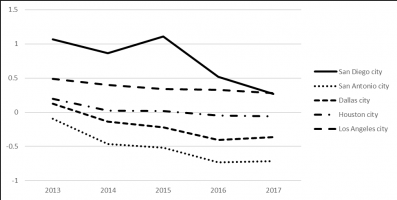

Recently, I used this measure to compare five of the fastest shrinking cities with five of the fastest growing cities in the United States during and after the Great Recession. The shrinking cities included Detroit (MI), Cleveland (OH), St. Louis (MO), Baltimore (MD) and Milwaukee (WI). The growing cities included Los Angeles (CA), Houston (TX), Dallas (TX), San Antonio (TX) and San Diego (CA). The results were interesting. During the recession the growing cities outperformed the shrinking cities in financial condition. Following the recession, the shrinking cities improved the most and actually outperformed the growing cities by the end of the study period in 2017. See figure 2 and 3.

Figure 2: Overall Financial Condition for Selected Shrinking Cities (2013 – 2017)

The result of this analysis shows that despite the perception that shrinking cities are more fiscally stressed than growing cities, this is not necessarily the case. This seems counter-intuitive until one considers how shrinking cities, which experience population-induced fiscal stress, are hyper-focused on improving their fiscal health. Unfortunately, this is to the detriment of investments in public infrastructure along with high taxes per capita to account for a declining tax base. A lack of public investment and high taxes per capita is a recipe for further population decline. A healthy local economy is dependent on quality infrastructure as well as high levels of human capital development. These are two aspects that are generally lacking in shrinking cities. When these cities should be investing, they are scaling back, leading to more population decline.

Figure 3: Overall Financial Condition for Selected Growing Cities (2013 – 2017)

This raises some questions about considering financial condition in absence of other indicators of community wellbeing. Shrinking cities are under pressure by their state governments to remain solvent. This manifests itself as a singular focus on this area of public management. This has also led to an increasing reliance on non-governmental entities to provide important community services. Governance in these cities has been described as reliant on collaborations and networks between government, non-profits and businesses in a structured, but non-hierarchical way. This has raised serious concerns about democracy when these entities are providing many of the services that a city government used to provide through accountable and transparent means. It also increases uncertainty in the long-term provision of these services. These are difficult problems without simple solutions, with shrinking cities continuing to lose population.

Author: Dr. Hummel is an assistant professor in the Department of Interdisciplinary Studies at Slippery Rock University. He teaches classes on civic engagement, leadership and financial decision making. His email is [email protected]. You can also visit his website: www.hummel-research.com.

(No Ratings Yet)

(No Ratings Yet)

Loading...

Loading...

Financial Condition and Population Decline: The Challenge in Attracting Residents

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Daniel Hummel

August 24, 2019

Tax base erosion has been described as one of the main reasons for local fiscal stress. This includes the out-migration of the middle and upper classes while the poorer classes remain behind. The city frequently spends more than it receives in tax revenues since the poor pay little or no taxes. A loss of population also signals increased housing vacancy. Vacant homes reduce the amount of property taxes paid while concordantly reducing the values of nearby homes and thereby their taxable value. Vacancy is also related to crime. An increase in crime can cause people to leave a city or part of a city while vacancy can also be a causal factor for crime. As crime increases the costs related to law enforcement increase as well, which further burdens the city government. Another impact from the loss of population is the critical capacity needed to maintain city services. This includes education, hospitals, public transportation and other areas. They need a critical mass to run efficiently. See figure 1 for how these factors interact to affect local financial condition.

Figure 1: Population-Induced Municipal Fiscal Stress Causal Diagram

These factors show how the loss of population can have detrimental effects on these cities’ budgets. Fiscal health is considered a core management goal. It is necessary to secure favorable terms to borrow for investments. In states like Michigan, local fiscal health is necessary to avoid state takeover, as states are directly impacted by local fiscal stress for their own credit ratings and responsibilities.

Fiscal health is usually measured as a comparison either to another unit or to itself over time. Several measures were developed in the 1970s and ‘80s as it became increasingly apparent that states and local governments were experiencing fiscal stress. The Federal government was cutting intergovernmental aid and several states experienced tax revolts starting with Proposition 13 in California.

One measure I like to use was developed by Wang, Dennis and Tu right before the Great Recession. This has become an increasingly popular measure. It measures the cash, budget, long-term and service solvency of the government. Cash solvency is focused on the cash standing of the government vis-à-vis current liabilities. Budget solvency is focused on revenues versus expenditures. This is the typical measure of fiscal health alone and has been adopted by organizations like the National League of Cities. Long-term solvency is focused on restricted and unrestricted assets vis-à-vis total assets, as well as long-term liabilities as compared to total assets. Service solvency is focused on taxes, revenues and expenditures on a per capita basis.

Recently, I used this measure to compare five of the fastest shrinking cities with five of the fastest growing cities in the United States during and after the Great Recession. The shrinking cities included Detroit (MI), Cleveland (OH), St. Louis (MO), Baltimore (MD) and Milwaukee (WI). The growing cities included Los Angeles (CA), Houston (TX), Dallas (TX), San Antonio (TX) and San Diego (CA). The results were interesting. During the recession the growing cities outperformed the shrinking cities in financial condition. Following the recession, the shrinking cities improved the most and actually outperformed the growing cities by the end of the study period in 2017. See figure 2 and 3.

Figure 2: Overall Financial Condition for Selected Shrinking Cities (2013 – 2017)

The result of this analysis shows that despite the perception that shrinking cities are more fiscally stressed than growing cities, this is not necessarily the case. This seems counter-intuitive until one considers how shrinking cities, which experience population-induced fiscal stress, are hyper-focused on improving their fiscal health. Unfortunately, this is to the detriment of investments in public infrastructure along with high taxes per capita to account for a declining tax base. A lack of public investment and high taxes per capita is a recipe for further population decline. A healthy local economy is dependent on quality infrastructure as well as high levels of human capital development. These are two aspects that are generally lacking in shrinking cities. When these cities should be investing, they are scaling back, leading to more population decline.

Figure 3: Overall Financial Condition for Selected Growing Cities (2013 – 2017)

This raises some questions about considering financial condition in absence of other indicators of community wellbeing. Shrinking cities are under pressure by their state governments to remain solvent. This manifests itself as a singular focus on this area of public management. This has also led to an increasing reliance on non-governmental entities to provide important community services. Governance in these cities has been described as reliant on collaborations and networks between government, non-profits and businesses in a structured, but non-hierarchical way. This has raised serious concerns about democracy when these entities are providing many of the services that a city government used to provide through accountable and transparent means. It also increases uncertainty in the long-term provision of these services. These are difficult problems without simple solutions, with shrinking cities continuing to lose population.

Author: Dr. Hummel is an assistant professor in the Department of Interdisciplinary Studies at Slippery Rock University. He teaches classes on civic engagement, leadership and financial decision making. His email is [email protected]. You can also visit his website: www.hummel-research.com.

Follow Us!