Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

How Will Work-from-Home Affect City Finances?

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By David Merriman

May 13, 2022

The COVID-19 pandemic and the associated stay-at-home orders resulted in once-in-a-lifetime disruption of business as usual. Some of their effects, such as the delay of routine medical procedures, due to over-crowded hospitals, and mask wearing may be transitory. Other effects may be more permanent, including remote work and education.

It is difficult to be certain which trends are permanent and which will fade as the pandemic recedes. My co-authors (Howard Chernick and David Copeland) and I have attempted to forecast future trends pertaining to the very large increase of people working at home.

We predict that labor force changes will cause a fall in demand for commercial real estate space, especially in dense downtown areas. This drop will cause the market value of such spaces to fall in the short run. With some lag, assessed values of commercial real estate will fall, as well as those required by most states’ property tax codes. These declines in assessed values will cause property tax revenue to decline, resulting insignificant fiscal stress in some cities.

We are forthright about the uncertainty in our estimates. First, the degree to which the work-from-home patterns will persist is debatable. We relied on a body of academic literature to narrow our estimates. Second, the speed with which drops in demand will be reflected in price movements is not known, but early indications suggest this may happen quickly. Finally, we recognize that it is conceivable cities could raise property tax rates to compensate for declines in property tax assessments. However, we think that is unlikely since it would require a politically unpopular shift of the tax burden toward owners and renters.

What did we find? In a preliminary report we looked at a diverse group of eight large cities: Los Angeles, San Francisco, Miami, Atlanta, Chicago, Charlotte, NYC and Austin. We found that employment loss was generally concentrated in a few industries—most notably accommodations and food services—but varied across cities. All cities experienced a sharp initial decline immediately after the onset of the pandemic in early 2020. After 12 months there was significant recovery in some cities, including Atlanta and Austin, but others like Los Angeles, Chicago and New York still had significant drops in employment. Other industries—most notably professional, scientific and technical services—experienced very small declines, or even growth, in employment. Even in industries where employment is stable or growing, we expect significant declines in the demand for office space as work-from-home becomes more widely accepted.

The extent of the decline in the demand for office space will depend upon the industry and city-specific change in employment and the extent to which work-from-home makes inroads in each industry. Our estimates take into account differences in industry composition and employment losses in each city. We developed three estimates for the change in demand for office and commercial space in each city. Our most conservative estimate assumed no change in work-from-home. Two more realistic estimates assumed work-from-home shares in key industries that range from 1.5 to three or more days per week. The implied change in the price of commercial and industrial real estate ranged from zero to 43 percent, depending upon the city. Even our most conservative assumption showed significant price declines in all 8 cities. Our high-end estimates averaged 31 percent.

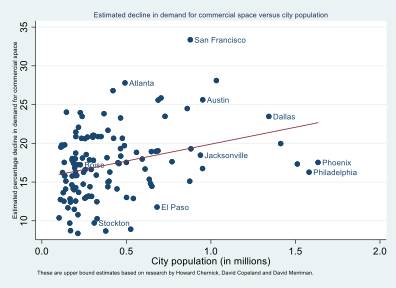

We are currently expanding the sample to include more than 100 cities with populations of 100,000 or more. As shown in the figure below, our preliminary estimates suggest similar patterns in this larger group of cities. We predict that some cities will experience very large declines in demand for commercial space but that smaller cities may experience somewhat smaller shocks because they are less likely to have heavy concentrations of employment in industries that are most likely to switch to work from home.

Large changes in demand for commercial and industrial real estate are likely to have significant fiscal effects. Declines in real estate prices will suppress assessments, and unless offset by rising rates, this will lead to declines in revenues. Because the share of the property tax in total revenues varies significantly across cities and the decline in real estate values will vary across cities, fiscal impacts will vary as well.

Our upper bound predictions for the percent decline in property tax revenues in our original eight city sample varied from more than 15 percent in Atlanta, NY and SF to about seven percent in Austin, and LA.

The impact on general revenues is smaller but still significant. Most notably, even though the property tax revenue decline was relatively small in Austin the impact on general revenues was significant because Austin is more reliant on property taxes for its revenue than other cities in the sample.

In sum, the impacts will depend on cities’ industrial structure, economic resilience in the face of the pandemic, share of the property tax base that is commercial and industrial and share of general revenue obtained from the property tax. By weighting these various factors, our quantitative estimates should be of use to city officials in anticipating and reacting to potential fiscal threats.

Author: David Merriman is the Interim Dean College of Urban Planning and Public Affairs, University of Illinois Chicago, and Faculty Advisory Panel Member, Government Finance Research Center, UIC. He can be reached at [email protected].

Willie L. Patterson III

May 15, 2022 at 4:48 pm

I retired from the Corps of Engineers in the Real Estate Division and returned part-time to help with leasing actions/ Interestingly, we have had some rumblings from the Government with potential space reduction in support of long-term telework. I completed my dissertation on telework in 2011. I suspect with the huge success of telework during the pandemic, we could easily see a 25% drop in space needs on a permanent basis. I have no empirical data at this point other than production being higher while working at home.. but I am starting to see a move towards more telework options–even full-time work-from-home opportunities.