An Information Campaign about Public Health Insurance Program Financing Could Facilitate Health Reform

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Cheryl A. Camillo

December 22, 2017

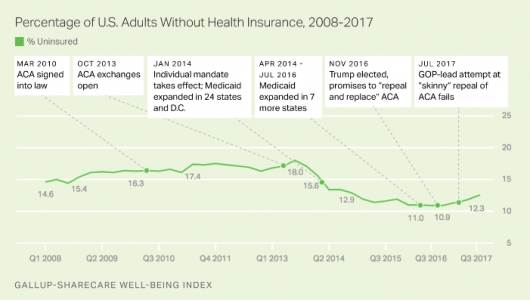

Many Americans believe beneficiaries of means-tested public health insurance programs, such as Medicaid, do not contribute towards their coverage by paying taxes. They are wrong; the vast majority of U.S. adults pay into state and/or federal general revenue funds, which are the main sources of program financing. Nonetheless, this mistaken belief fuels opposition to the programs, which inhibits efforts to ensure all Americans have the comprehensive health insurance they need to access healthcare services. This ignorance must be addressed because the U.S. uninsurance rate is rising rapidly again and many insured individuals are not getting the healthcare they need due to high out-of-pocket costs. A public information campaign about program financing could reduce resentment between Americans thereby leading to a breakthrough in health policymaking.

Source: http://news.gallup.com/poll/220676/uninsured-rate-rises-third-quarter.aspx

The notion that Medicaid beneficiaries do not “earn” their benefits is reflected in this comment by an anonymous supporter of Indiana’s request for federal approval to impose work requirements, one of several such proposals the Trump Administration has encouraged states to submit:

“I have to pay for my health insurance coverage so those who get it for ‘free’ should either be working, looking for work, or in school unless disability keeps them from finding employment.”

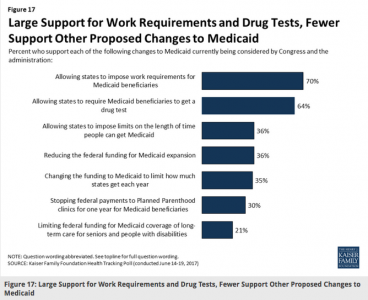

Seventy percent of Americans support Medicaid work requirements, according to a June poll conducted by the Kaiser Family Foundation. Many, no doubt, share the above commenter’s sentiment. Similar expressions can be found in social media posts and on car bumpers — one notable sticker reads “Honk if I’m paying your health insurance!”

Source: https://www.kff.org/health-reform/poll-finding/kaiser-health-tracking-poll-june-2017-aca-replacement-plan-and-medicaid/

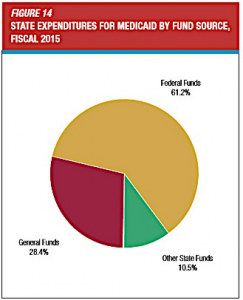

Yet, contrary to popular belief, most adult Americans “pay into” Medicaid. The federal and state governments jointly finance Medicaid and nearly all federal and three-quarters of state funds are drawn from general revenues. The federal government pays just over 60 percent of total costs (in the form of reimbursements to states who pay participating providers for services then submit matching claims to the feds) and states pay the remaining 40 percent. Over 80 percent of federal general revenues come from individual income and payroll taxes and 60 percent of state general revenues derive from sales taxes, user charges, and individual income taxes. Since almost every American shops for essential or luxury goods in person or online, most Americans pay sales taxes, if not user charges and income and payroll taxes.

Source: National Association of State Budget Officers

Ignorance about healthcare financing makes it difficult to enact policies that will make health insurance and care accessible for most Americans. Given there are no education requirements for Members of Congress and the President, some elected officials enter office with little or bad information about program financing, which means they cannot make informed decisions. Indeed, President Trump admitted that was the case when he said after one month in the White House “I have to tell you, it’s an unbelievably complex subject. Nobody knew that healthcare could be so complicated.” Those politicians who are well-informed must reconcile contradictory requests, such as “Keep the government out of my Medicare,” from confused constituents. Some might choose not to do so because public ignorance could serve their or their party’s self-interest in that it can be exploited, rightfully or not, to pit population groups against one another, such as citizens against immigrants.

A public education/communications campaign is imperative. The FrameWorks Institute, an independent nonprofit organization that conducts scientific research on social topics, concluded the same after conducting in-depth interviews on the relationship between taxes and budgets with a range of Americans. Frameworks identified a missing link, or “cognitive hole” between taxes and public budgets in the minds of Americans and suggested that:

“… reformers need to put considerable effort toward providing the public with new models for how to think about these concepts—models that focus on illuminating the processes that underlie budgets and taxes, the systems into which they fit and, most importantly, their conceptual interrelationship in vivid, concrete, compelling, and innovative ways.”

Possible components of a larger campaign include:

- Giving beneficiaries information about how public health insurance programs are financed during their application and enrollment process; and,

- Providing the public with information about how (and from which population groups) federal and state governments collect tax revenue during the annual income tax filing season.

For example, the federal Centers for Medicare & Medicaid Services could add a section to the 136 page Medicare & You handbook it sends each beneficiary each year explaining that, while the program is funded through payroll taxes, there is no direct relationship between an individual’s Medicare payments and benefits. Therefore, an individual could receive Medicare benefits whose value (in terms of premiums and claims paid by the federal government) exceeds his/her cumulative tax payments or not. Similarly, the Internal Revenue Service and state tax agencies could provide information about the sources and uses/allocation of tax revenues within their annual individual income tax booklets.

More personalized, but potentially costlier, approaches could include providing annual Medicare or Medicaid statements similar to the Social Security Administration’s “Social Security Statement,” which tabulates annual tax payments and estimates likely benefits. Research has concluded that Social Security Statements do improve knowledge.

Additional ideas could be drawn from other nations’ practices.

Author: Cheryl A. Camillo is an assistant professor at the Johnson Shoyama Graduate School of Public Policy. A former public administrator at the U. S Department of Health and Human Services and Maryland Department of Health, she works to bring together scholars and practitioners to solve real-world health policy problems. She can be reached at [email protected] or via Twitter @CherylACamillo.

(No Ratings Yet)

(No Ratings Yet)

Loading...

Loading...

An Information Campaign about Public Health Insurance Program Financing Could Facilitate Health Reform

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Cheryl A. Camillo

December 22, 2017

Many Americans believe beneficiaries of means-tested public health insurance programs, such as Medicaid, do not contribute towards their coverage by paying taxes. They are wrong; the vast majority of U.S. adults pay into state and/or federal general revenue funds, which are the main sources of program financing. Nonetheless, this mistaken belief fuels opposition to the programs, which inhibits efforts to ensure all Americans have the comprehensive health insurance they need to access healthcare services. This ignorance must be addressed because the U.S. uninsurance rate is rising rapidly again and many insured individuals are not getting the healthcare they need due to high out-of-pocket costs. A public information campaign about program financing could reduce resentment between Americans thereby leading to a breakthrough in health policymaking.

Source: http://news.gallup.com/poll/220676/uninsured-rate-rises-third-quarter.aspx

The notion that Medicaid beneficiaries do not “earn” their benefits is reflected in this comment by an anonymous supporter of Indiana’s request for federal approval to impose work requirements, one of several such proposals the Trump Administration has encouraged states to submit:

“I have to pay for my health insurance coverage so those who get it for ‘free’ should either be working, looking for work, or in school unless disability keeps them from finding employment.”

Seventy percent of Americans support Medicaid work requirements, according to a June poll conducted by the Kaiser Family Foundation. Many, no doubt, share the above commenter’s sentiment. Similar expressions can be found in social media posts and on car bumpers — one notable sticker reads “Honk if I’m paying your health insurance!”

Source: https://www.kff.org/health-reform/poll-finding/kaiser-health-tracking-poll-june-2017-aca-replacement-plan-and-medicaid/

Yet, contrary to popular belief, most adult Americans “pay into” Medicaid. The federal and state governments jointly finance Medicaid and nearly all federal and three-quarters of state funds are drawn from general revenues. The federal government pays just over 60 percent of total costs (in the form of reimbursements to states who pay participating providers for services then submit matching claims to the feds) and states pay the remaining 40 percent. Over 80 percent of federal general revenues come from individual income and payroll taxes and 60 percent of state general revenues derive from sales taxes, user charges, and individual income taxes. Since almost every American shops for essential or luxury goods in person or online, most Americans pay sales taxes, if not user charges and income and payroll taxes.

Source: National Association of State Budget Officers

Ignorance about healthcare financing makes it difficult to enact policies that will make health insurance and care accessible for most Americans. Given there are no education requirements for Members of Congress and the President, some elected officials enter office with little or bad information about program financing, which means they cannot make informed decisions. Indeed, President Trump admitted that was the case when he said after one month in the White House “I have to tell you, it’s an unbelievably complex subject. Nobody knew that healthcare could be so complicated.” Those politicians who are well-informed must reconcile contradictory requests, such as “Keep the government out of my Medicare,” from confused constituents. Some might choose not to do so because public ignorance could serve their or their party’s self-interest in that it can be exploited, rightfully or not, to pit population groups against one another, such as citizens against immigrants.

A public education/communications campaign is imperative. The FrameWorks Institute, an independent nonprofit organization that conducts scientific research on social topics, concluded the same after conducting in-depth interviews on the relationship between taxes and budgets with a range of Americans. Frameworks identified a missing link, or “cognitive hole” between taxes and public budgets in the minds of Americans and suggested that:

Possible components of a larger campaign include:

For example, the federal Centers for Medicare & Medicaid Services could add a section to the 136 page Medicare & You handbook it sends each beneficiary each year explaining that, while the program is funded through payroll taxes, there is no direct relationship between an individual’s Medicare payments and benefits. Therefore, an individual could receive Medicare benefits whose value (in terms of premiums and claims paid by the federal government) exceeds his/her cumulative tax payments or not. Similarly, the Internal Revenue Service and state tax agencies could provide information about the sources and uses/allocation of tax revenues within their annual individual income tax booklets.

More personalized, but potentially costlier, approaches could include providing annual Medicare or Medicaid statements similar to the Social Security Administration’s “Social Security Statement,” which tabulates annual tax payments and estimates likely benefits. Research has concluded that Social Security Statements do improve knowledge.

Additional ideas could be drawn from other nations’ practices.

Author: Cheryl A. Camillo is an assistant professor at the Johnson Shoyama Graduate School of Public Policy. A former public administrator at the U. S Department of Health and Human Services and Maryland Department of Health, she works to bring together scholars and practitioners to solve real-world health policy problems. She can be reached at [email protected] or via Twitter @CherylACamillo.

Follow Us!