Integrating Interconnected Frameworks

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Kevin P. Riley

June 16, 2019

A new, integrated resource management framework

Earlier this year the State of Victoria’s Department of Treasury and Finance (DTF) released a new integrated resource management framework (RMF). This framework will become effective on July 1, 2019.

Merging the interconnected budget operations framework and performance management framework into a revised, updated and single RMF has integrated public sector planning, budgeting, service delivery, accountability and evaluation.

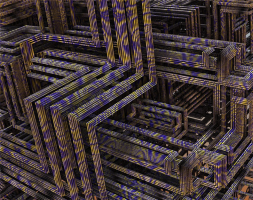

The RMF introduces the integrated management cycle (IMC), shown as figure 1 below.

Figure 1 – Integrated management cycle

At the heart of the IMC is the legal and policy framework. It is through the legal and policy framework that the legislature provides the legal authority for the executive to collect and spend public money. It sets out key requirements, including that:

- All revenue shall be collected through the consolidated fund.

- The legislature may only appropriate public money on the initiative of the executive.

- Revenue may be appropriated to specific purposes, as legislated through annual appropriation bills.

- Annual appropriations bills may only deal with appropriations of public money.

Around the legal and policy framework, the six phases of the IMC work together to integrate:

- Specifying and aligning departmental objectives to government priorities, supported by key effectiveness indicators.

- Describing the outputs (or services) to be delivered to citizens and government and establishing measures of output performance as a mix of quality, quantity, timeliness and cost.

- Setting out the components of a comprehensive planning framework.

- Describing the major funding policies and legal mechanisms that support the state’s financial management strategy, including the budget process, funding model, varying the funding of departments within the year based on changes to output mix and pricing, transfers, carryovers and borrowing from future appropriations.

- Establishing the mechanisms for the executive to discharge their accountability to the legislature for the overall financial and performance management of the state sector, and departmental and whole-of-government reporting obligations, demonstrating how resources have been used across the state sector.

- Recommending regularly reviews of the base funding of outputs to ensure that public spending on outputs remains efficient and effective and considering the continued relevance of outputs delivered to achieve outcomes for citizens, and the appropriateness of the price paid for these services.

Key performance attributes of the new integrated resource management framework

The RMF enhances financial and non-financial performance reporting by state government departments.

Financial performance

A key control within the legal and policy framework is the appropriation limit. This limits the maximum amounts able to be legally drawn from the consolidated fund.

However:

- Appropriations do not limit the operating expenses incurred by departments.

- Expenses incurred by departments will give rise to liabilities and departments are legally bound to meet these liabilities as, and when, they fall due.

Setting a net cost of service limit in the RMF assists is managing expenses and liabilities.

These two financial limits integrate cash-based and accrual-based concepts.

A unique control within the RMF is the concept of revenue certification. Departments need to demonstrate that the outputs have been delivered in full and to the standards of quality, timeliness and quantity as set out in the budget papers. Assessing actual performance against budget or planned performance measures will determine the proportion of the appropriation that has been earned as revenue, and the proportion that has been received as a loan.

Demonstrating the ability to live within appropriation and net cost of service limits as well as revenue certification will require managers and senior executives to demonstrate higher standards of financial literacy, reading and acting on both cash and accrual reports and forecasts, together with a focus on delivering services to agreed standards, and not just spending public money.

The RMF also looks to overcome the concept of, “Spend it or lose it.” More flexible arrangements for carrying forward unspent appropriations and surpluses, and borrowing from future appropriations, empowers departments to adopt more strategic approaches to financial management. Senior executives will need to articulate their department’s multi-year financial strategy.

Output performance

The RMF focuses attention on the delivery of outputs and the services delivered to citizens and government. Planning and reporting will be required on:

- Agreed quantity, quality, timeliness and cost measures.

- Key strategic performance issues that are material to the performance of the department and that are likely to impact on key government priorities.

Being confident in demonstrating how a department’s service delivery model will achieve the outcomes citizens and communities expect will become a key requirement for managers and executives. Developing skills in performance management (defining, measuring, monitoring and acting on efficiency and effectiveness measures) will be needed under the new framework.

By integrating these interconnected frameworks, we will see more integrated and less stove-piped approaches to budgeting and planning, as well as improved decision making about resource allocation. DTF should be congratulated for developing the new RMF.

Further improvements to decision making about resource allocations could be achieved by one more integration project. Integrating the risk management framework within the new resource management framework would be a further enhancement to the good work already completed.

Author: Kevin P Riley is the Managing Partner of GPA Partners, a Canberra based firm advising on governance, performance and accountability matters. Kevin was born in Warwick, R.I. and continues to closely follow U.S. governance arrangements. Kevin is a Fellow with both CAANZ and CPA Australia and is a Qualified Accountant with the UK based CIPFA. Kevin is a National Councillor of the Institute of Public Administration Australia Inc. Kevin can be contacted by email at [email protected].

(5 votes, average: 5.00 out of 5)

(5 votes, average: 5.00 out of 5)

Loading...

Loading...

Integrating Interconnected Frameworks

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Kevin P. Riley

June 16, 2019

A new, integrated resource management framework

Earlier this year the State of Victoria’s Department of Treasury and Finance (DTF) released a new integrated resource management framework (RMF). This framework will become effective on July 1, 2019.

Merging the interconnected budget operations framework and performance management framework into a revised, updated and single RMF has integrated public sector planning, budgeting, service delivery, accountability and evaluation.

The RMF introduces the integrated management cycle (IMC), shown as figure 1 below.

Figure 1 – Integrated management cycle

At the heart of the IMC is the legal and policy framework. It is through the legal and policy framework that the legislature provides the legal authority for the executive to collect and spend public money. It sets out key requirements, including that:

Around the legal and policy framework, the six phases of the IMC work together to integrate:

Key performance attributes of the new integrated resource management framework

The RMF enhances financial and non-financial performance reporting by state government departments.

Financial performance

A key control within the legal and policy framework is the appropriation limit. This limits the maximum amounts able to be legally drawn from the consolidated fund.

However:

Setting a net cost of service limit in the RMF assists is managing expenses and liabilities.

These two financial limits integrate cash-based and accrual-based concepts.

A unique control within the RMF is the concept of revenue certification. Departments need to demonstrate that the outputs have been delivered in full and to the standards of quality, timeliness and quantity as set out in the budget papers. Assessing actual performance against budget or planned performance measures will determine the proportion of the appropriation that has been earned as revenue, and the proportion that has been received as a loan.

Demonstrating the ability to live within appropriation and net cost of service limits as well as revenue certification will require managers and senior executives to demonstrate higher standards of financial literacy, reading and acting on both cash and accrual reports and forecasts, together with a focus on delivering services to agreed standards, and not just spending public money.

The RMF also looks to overcome the concept of, “Spend it or lose it.” More flexible arrangements for carrying forward unspent appropriations and surpluses, and borrowing from future appropriations, empowers departments to adopt more strategic approaches to financial management. Senior executives will need to articulate their department’s multi-year financial strategy.

Output performance

The RMF focuses attention on the delivery of outputs and the services delivered to citizens and government. Planning and reporting will be required on:

Being confident in demonstrating how a department’s service delivery model will achieve the outcomes citizens and communities expect will become a key requirement for managers and executives. Developing skills in performance management (defining, measuring, monitoring and acting on efficiency and effectiveness measures) will be needed under the new framework.

By integrating these interconnected frameworks, we will see more integrated and less stove-piped approaches to budgeting and planning, as well as improved decision making about resource allocation. DTF should be congratulated for developing the new RMF.

Further improvements to decision making about resource allocations could be achieved by one more integration project. Integrating the risk management framework within the new resource management framework would be a further enhancement to the good work already completed.

Author: Kevin P Riley is the Managing Partner of GPA Partners, a Canberra based firm advising on governance, performance and accountability matters. Kevin was born in Warwick, R.I. and continues to closely follow U.S. governance arrangements. Kevin is a Fellow with both CAANZ and CPA Australia and is a Qualified Accountant with the UK based CIPFA. Kevin is a National Councillor of the Institute of Public Administration Australia Inc. Kevin can be contacted by email at [email protected].

Follow Us!