Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

Managing Chaos in the Public Sector, Part II

A note for our readers: the views reflected by the authors do not reflect the views of ASPA.

By David Chapinski

This is part two of an article on open government and public-private partnerships.

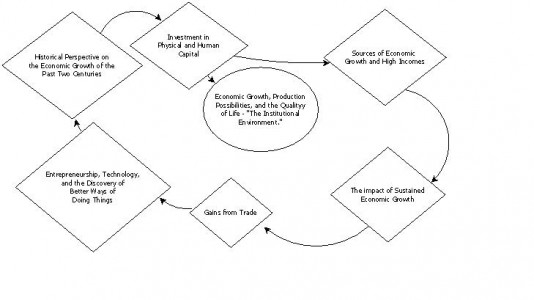

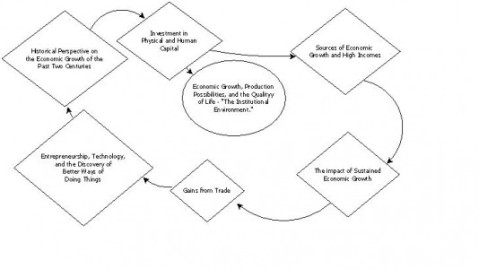

Creating an Environment for Growth and Prosperity

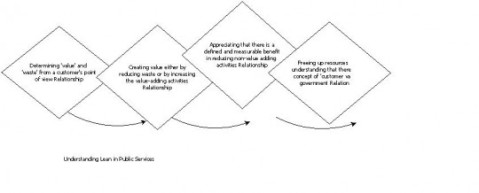

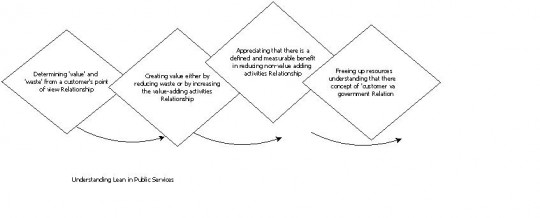

‘Lean’ has become a popular approach to public service reform. For fast-moving sectors, the benefit of bundling needed to be weighted against the cost of contract rigidity. This cost may be severe enough to make PPs unsuitable when users’ needs evolve rapidly. However, it takes two to tango. We must understand co-production of public services by integrating the services management and public administration perspectives.

‘Lean’ has become a popular approach to public service reform. For fast-moving sectors, the benefit of bundling needed to be weighted against the cost of contract rigidity. This cost may be severe enough to make PPs unsuitable when users’ needs evolve rapidly. However, it takes two to tango. We must understand co-production of public services by integrating the services management and public administration perspectives.

Streamlining governance, increasing transparence and accountability, setting tangible benchmarks and so on are unequivocally laudable. They have been welcomed by objective opinion. The hope is more that it will be sustained rather than collapse. We have been set wise to the urgency of holistic macro-economic plans with high public investment in the rural areas where infrastructure is needed most and which at the same time has the potential of creating more jobs than with urban investment. The hope in the national interest is that the government will be persistent and come to terms through practice with the axiomatic truths on which India straddled a bipolar world (now back in the reckoning). Economists will agree, there has been an administrative collapse. But can it be restored by the Centre alone?

The path toward correction is the revitalization of the states. The prescription offered is greater decentralization and devolution to energize these state units, along with smooth land acquisition and enforcement. We must consider the factors that affect the optimal allocation of demand risk and their implications for the use of user charges and the choice of contract length. Taxation in America is largely viewed as a means of generating income to keep the government in business. In recent years, progress has been made toward increasing total revenue, but most countries in the region still lag well behind other countries with similar levels of development. More importantly, policymakers still largely ignore the potential of taxation to contribute to other important development goals. Governments have repeatedly missed the chance to influence consumption and production patterns by using taxes to effect relative price changes. Here is my model for improvement.

What is this public service-dominant business logic and is this genuine potential? We need to consolidate the values of change, continuity, diversity and innovation. Managing and leading public service organizations means one of the most perilous quick fixes is the practice of taking costs out of one fund and transferring them to another. New York did that in 1992, when it balanced its general fund budget by taking the state’s historic canal system and moving it to the Thruway Authority. The canal system, which includes the Erie Canal, has traditionally been a financial black hole — it costs up to $90 million to run each year but generates only a few million dollars in revenue. The deficiencies are highlighted every time the Thruway raises its tolls, particularly during a stretch in the 2000s when it raised tolls four out of five years to cover the canal system. The problem is that New York never solved the real issue — the canals are simply draining a different fund. Created was simply the illusion that things were in balance even though one has not actually changed any of the financial facts. In the case of the Thruway Authority, the issues with the Erie Canal did not go away.

The innovative credentials are evident. The pedigree of the institution as a very progressive and innovative tertiary institution exists. Undoubtedly, this calls for a rethinking attitude and diversification in order to resolve this vital skills-deficits and shortage we cannot afford. The discipline of public budgeting and finance we need is not fiscal austerity but a “sustained commitment to prosperity that is both vigilant and flexible–and values what is good for the public as a whole.

Author: David M Chapinski is a doctoral candidate in the School of Public Affairs and Administration at Rutgers University. He is also an adjunct professor at both Felician College and Long Island University. Chapinski can be reached at [email protected].

Follow Us!