Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

A Poor Decision Made Worse? The Use of Capital Appreciation Bonds by School Districts

By Marc K. Fudge

What alternatives do school districts have when faced with the need for new facilities yet insufficient funds to pay for capital projects? Over the past several years, many schools across the country have resorted to issuing capital appreciation bonds to finance large-scale projects. At first glance they seem like a good idea. That is until you realize that when all is said and done, repayment can amount to 10 times as much as was financed. So, for example, if a school district issued a capital appreciation bond for $100 million, the amount the school district could end up repaying is likely to approach $1 billion dollars. Is this a good idea? How do schools get themselves in this predicament in the first place?

Insufficient Funds for School Resources

A common problem facing many school districts across the country is financing large capital projects. Being ever mindful of academic achievement, profi- cient test scores and safety, among many other concerns, schools also want to ensure that learning occurs in an environ-ment with modern facilities.

For the past 35 years, local governments within California have felt the fiscal crunch resulting from the well-known tax and expenditure limitation (TEL) Proposition 13. One of the primary provisions under Proposition 13 was that the property tax rate could not exceed 1 percent of the assessed value of the property. Because property tax revenue represents the largest income generator of local governments, Proposition 13 has obvious long-term effects for local governments in California. As residents continue to grapple with rising property taxes and states aim to meet their needs, schools are forced to be creative when new and modernized facilities become necessary.

Comparison between Current Interest Bonds and Capital Appreciation Bonds

Historically, states and local governments have not been interested in committing to long-term debt obligations which may result in interest payments amounting to three, four or more times the original amount borrowed. As a result of the “Great Recession,” many local governments and school districts have found it difficult to raise revenue and finance capital projects. This may have been especially true in school districts where there is a limit on how much they can receive from the assessments made on declining property values.

Most municipal bonds pay interest on a semiannual or quarterly basis, at the same rate over their entire length of the bond and are issued from 10 to 30 years. These standard bond instruments are called current interest bonds (CIBs). A capital appreciation bond (CAB) is a municipal security on which the investment return on an initial principal amount is reinvested at a stated rate until maturity, at which time the investor receives a single payment representing the face value of the bond and all accrued interest. The two major options for schools to finance capital expenditures are CIBs and CABs. Below is a chart depicting the major differences between current interest bonds and capital appreciation bonds.

Major Differences Between Current Interest Bonds and Capital Appreciation Bonds

| Current Interest Bonds | Capital Appreciation Bonds |

| Principle and interest are paid quarterly or semi-annually over term of bond | Principle and compounded interest paid at maturity |

| Typically callable (refinance) after 10 years | Usually not callable |

| Cost ratio is typically 2, or 2.5 to 1 | Cost ratio varies from 4 to 1 up to as much as 16 to 1 |

| The term of the bond is usually 10 to 25 years | Term of bond can be as long as 40 years |

| Repayment begins in the first year | Repayment is deferred for several years |

| Repayments count against property tax rate | Deferred repayment counts against rate restriction as it becomes due |

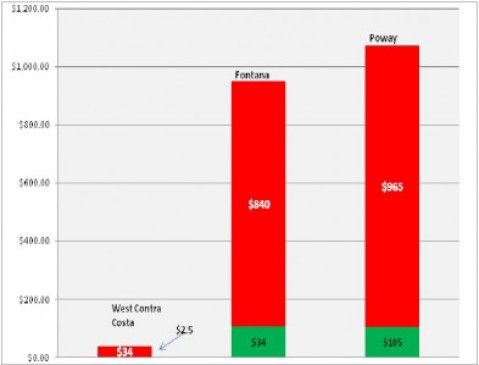

The chart below displays three California school districts who issued CABs over the past three years. The amount in the green part of the column represents how much the CAB was issued for. Note that the amount in the first column for West Contra Costa School District is so small that it is barely shown. The amount in the red part of the column represents the amount that will be due upon repayment.

CAB Issued and Dollar Amount Due for Repayment

A Poor Decision or No Alternative?

As a public administrator, you may ask yourself “why would anyone support the use of CABs?” The answer may not be as clear-cut or simple as you may think. For example, let us take a school board member who recently won an election based, in part, on the promise of modernizing schools in the district. Parents and residents of the community believe, as you stated, that older schools would be retrofitted to offer similar features as the newer schools. Because of insufficient finances and perhaps the unlikely passage of a tax increase you are left with few alternatives. In an effort not to raise taxes and to meet the campaign promises, the school district’s financial advisors suggest you issue a capital appreciation bond. Problem solved.

Another potential reason why CABs may be issued is the complex nature of their structure. Those who are unfamiliar with public finance and municipal bonds may not be in the best position to make a decision with these consequences. Finally, even if one was equipped to make a decision such as this, s/he may be betting that, over the long-term, property value will increase enough where those revenues could pay the bond at the time payment is required.

Some states such as Michigan have outlawed the use of CABs altogether. In California, Governor Brown recently signed legislation curbing many of the issues associated with CABs. The legislation aims to do to the following:

- Limit total debt service to 4 times the principal

- Limit the duration (maturity) to 25 years

- Require districts the ability to repay loan if duration/maturity is longer than 10 years

- Require school districts to discuss CABs at an informational meeting that compares them to CIBs

Are Capital Appreciation Bonds Ever a Good Idea?

The news media would have you believe that all CABs are bad and are never a good idea. However, when properly used CABs can provide short-term funding for local governments that are experiencing growth, knowing that the tax base will increase and they can handle incurred costs. An example would be a newly planned city that anticipates substantial growth over the next several years. Another advantage to a CAB is that it provides immediate funding for capital facilities without the associated increase in tax rates.

What’s Next?

It is unreasonable to assume that all school officials are incompetent and make decisions that others, armed with the same information, would not do—but it is occurring. Future studies may examine the factors influencing school districts into making decisions that seem to be sacrificing the future well-being of their communities for current political reasons. Natalie Cohen stated, in a 1989 Journal of Public Budgeting and Finance article titled, “Municipal Default Patterns – An Historical Study,” that in addition to regional land development cycles, wide-eyed optimism in project planning and underestimating construction costs, financial mismanagement has repeatedly caused local government defaults. What are the chances that 30 years from now the issuance of CABs will cause many cities to go broke because of an unwise decision made today? We can only hope that they are slim.

Marc K. Fudge, Ph.D. is an assistant professor within the Department of Public Administration at California State University San Bernardino. His research focuses on performance management, public budgeting and finance and e-government. He can be reached via email at: [email protected].

(4 votes, average: 4.75 out of 5)

(4 votes, average: 4.75 out of 5)

Follow Us!