Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

What the 2016 Political “Earthquake” Portends for the Future Role of the Federal Government

The views expressed are those of the author and do not necessarily reflect the views of ASPA as an organization.

By Erik Devereux

April 20, 2018

One of my teachers, Walter Dean Burnham, is an advocate of using geological metaphors to understand longer term political patterns. I am going to use his approach to write now for the first time about what happened to American politics in 2016 and the longer-term implications for the Federal Government (and its workforce). In doing so, I am not going to focus on any specific individuals, not even the current president of the United States. I don’t subscribe to the “Great Man” theory of history (or the “Terrible Man” theory either), and nor should you.

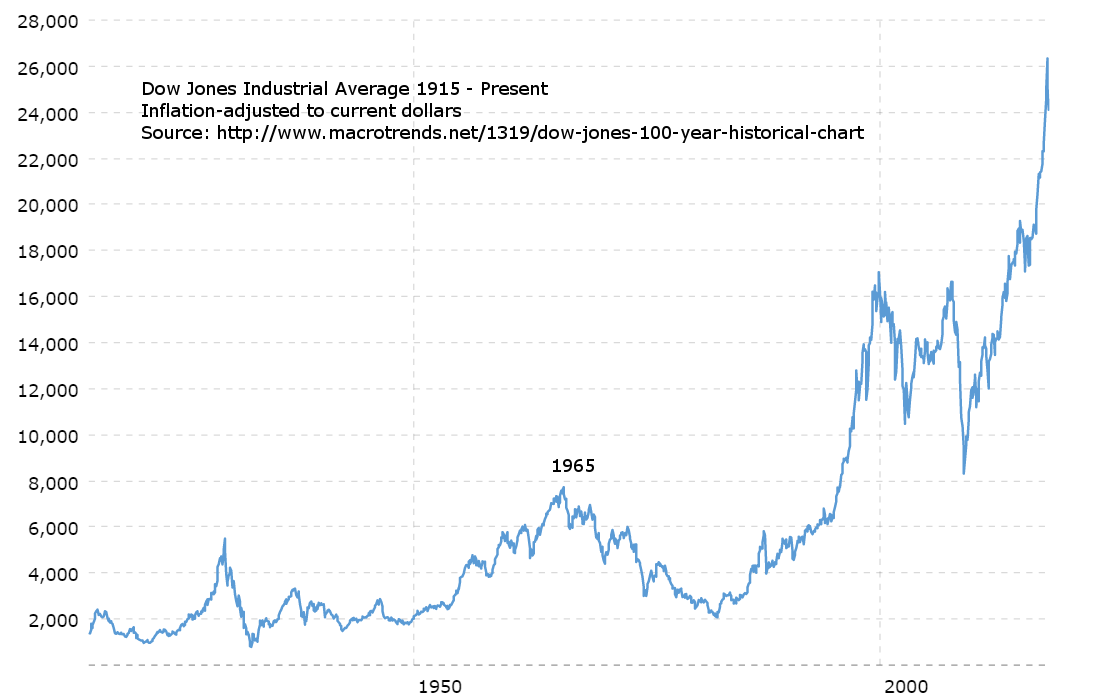

Since approximately 1965, the relative position of the American economy in the world has been in a gradual decline when measured by such factors as share of total global output. Most American would be surprised to know that only in the mid-1990s did the value of the U.S. stock market in real (inflation adjusted) terms exceed that in 1965 (see the chart accompanying this column). I’ll come back to the stock market in a few paragraphs. Generally, most indicators of the U.S. economy have been trending downward for decades when placed in a global context.

That this would happen seemed inevitable to political and economic leaders in the U.S. in the 1970s and 1980s as they looked out at a world finally recovered from World War Two and in need of significant economic growth in Asia to prevent another major war. In fact, former chairman of the Federal Reserve Paul Volker has spoken openly about having to manage the impact of the decline on U.S. workers—a permanent decline in their current and future standards of living—as peacefully as possible.

Going back to the geology of it, economically and politically the United States began to experience the grinding of powerful, perhaps unstoppable, “tectonic plates” related to the end of the 1945-1965 period of unprecedented prosperity for unskilled and semi-skilled industrial workers, and many other workers as well. These pressures built up for decades at a time, then yielded extreme voter dissatisfaction with the “status quo” as expressed by Ronald Reagan in 1981, Bill Clinton in 1992, Barack Obama in 2008 and Donald Trump in 2016. Say or do what they would, none of these presidents really could do much to influence the longer-term pressures pushing the standard of living in the United States down toward the global average.

I do wish that some of the more enlightened leaders of the 1960s could have continued to influence U.S. fiscal policies during the period after 1965. Some of them clearly recognized that it was important for social stability, and even for the longer-term interests of the wealthy in this country, that the Federal Government use progressive taxation and relatively high levels of safety net spending to mitigate the economic misery unleased on the majority of voters by the post-1965 decline. Today, all I can wish is that leaders read and fully absorb the lessons in Thomas Picketty’s masterpiece, Capital in the 21st Century.

Picketty careful explains why the “neo-liberal” policies of tax cuts and efforts to eliminate the social safety net have exacerbated income and wealth inequality at a time when our country needs policies that help to support lower income workers directly impacted by globalization. The current value of the stock market is absurd in the context of the overall position of the U.S., but it reflects several decades of policies that have, “put out the fire with gasoline,” rather than allocating a reasonable share of economic growth to wage earners.

But what about the federal government itself? I argue that the non-stop attacks on the role of government and its workers are another misplaced expression of those grinding geological processes unleased after 1965. Unfortunately, the results have been the exact opposite of what the U.S. desperately needs at this critical juncture: A large, effective, well-financed administrative state that can steer through the ongoing globalization in a way that prevents extreme social instability. We need leadership that does not exploit that instability but works non-stop to forge a new compromise among the wealthy, the poor and the middle class regarding tax and spending policies that benefit all.

Doing so will restore a true sense of purpose to the federal workforce that, now, is besieged from all sides and experiencing a terrible crisis of low morale. That crisis is entirely unacceptable, and those who would foster that crisis really do not understand what they are doing. The lesson coming at them is harsh: Regardless of their beliefs, the forces at play in the global economy will do what they will do. Our calling should be to help the federal government play its rightful role in riding out the consequences, repairing damage from the earthquakes ahead and doing what can be done to limit human suffering.

Author: Erik Devereux has worked for 25 years in the public policy and management field. Erik currently is an independent consultant to nonprofit organizations and to higher education and teaches applied policy analysis at Georgetown University. He has a B.S. from the Massachusetts Institute of Technology (Political Science, 1985) and a Ph.D. from the University of Texas at Austin (Government, 1993). Contact Erik at [email protected].

Follow Us!